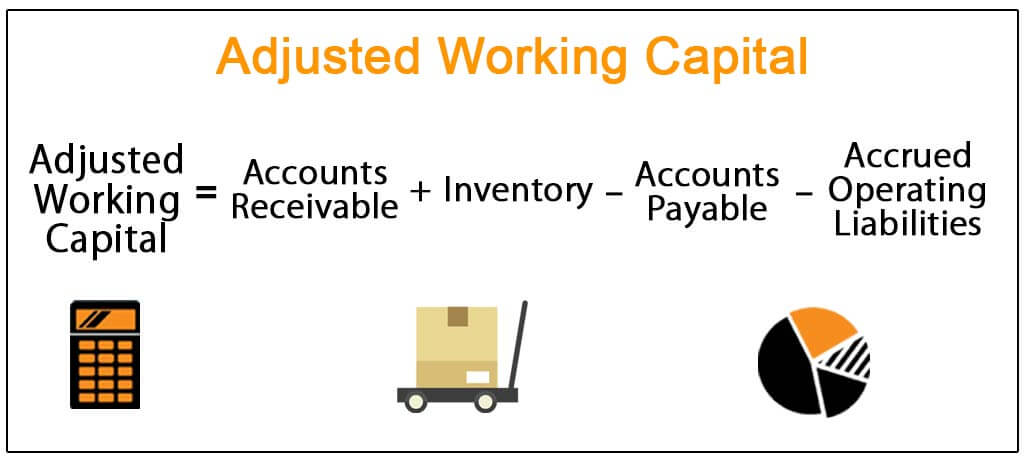

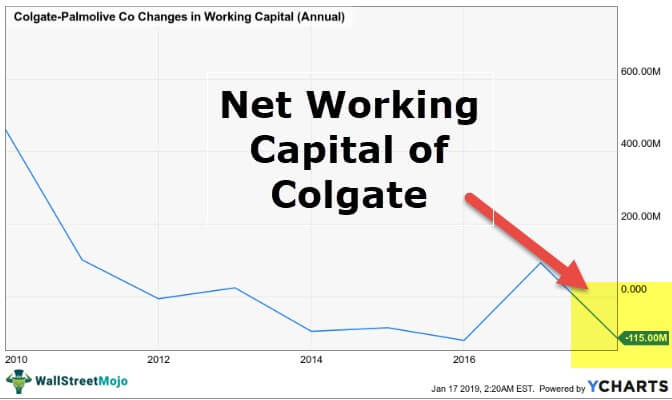

The following tables illustrate typical working capital trends seen in these categories Working capital amounts can be small at one company and quite significant at another Looking at working capital as part of the total deal or in relation to sales, can show that it varies in importance from company to companyThis increases the level of investment in working capital due to increased debtors balances and its administration costs But if the sellers' market prevails, the quick disposal of stocks, high percentage of cash sales, strict credit and collection policies etc, reduces the need for working capital The starting point for determining the working capital level of a business is to identify the assets and liabilities included in the calculation Working capital is most commonly defined as net current assets (excluding cash) adjusted for any debtlike items such as corporation tax liabilities, loans and hire purchase liabilities

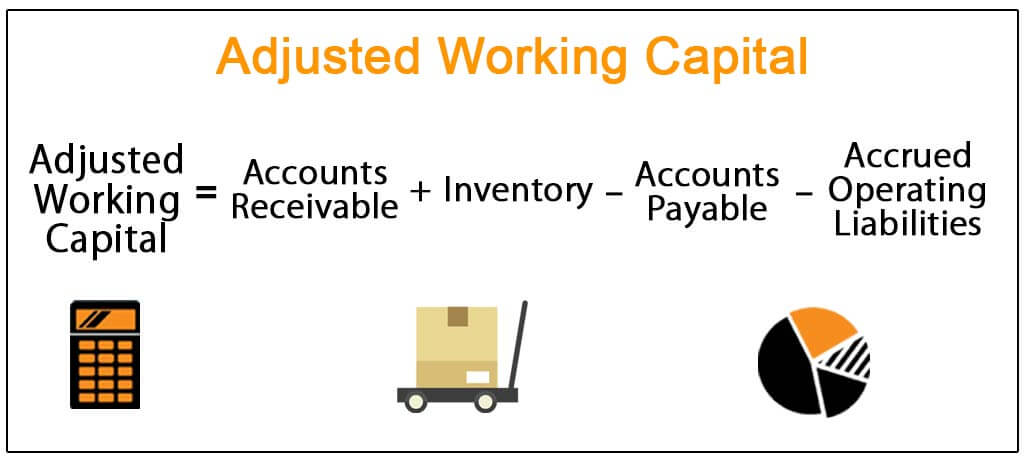

Adjusted Working Capital Definition Formula Example

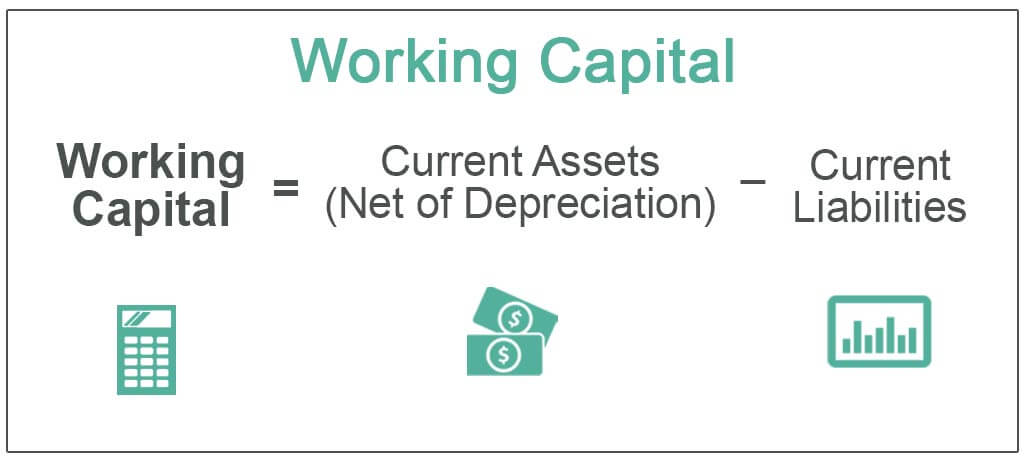

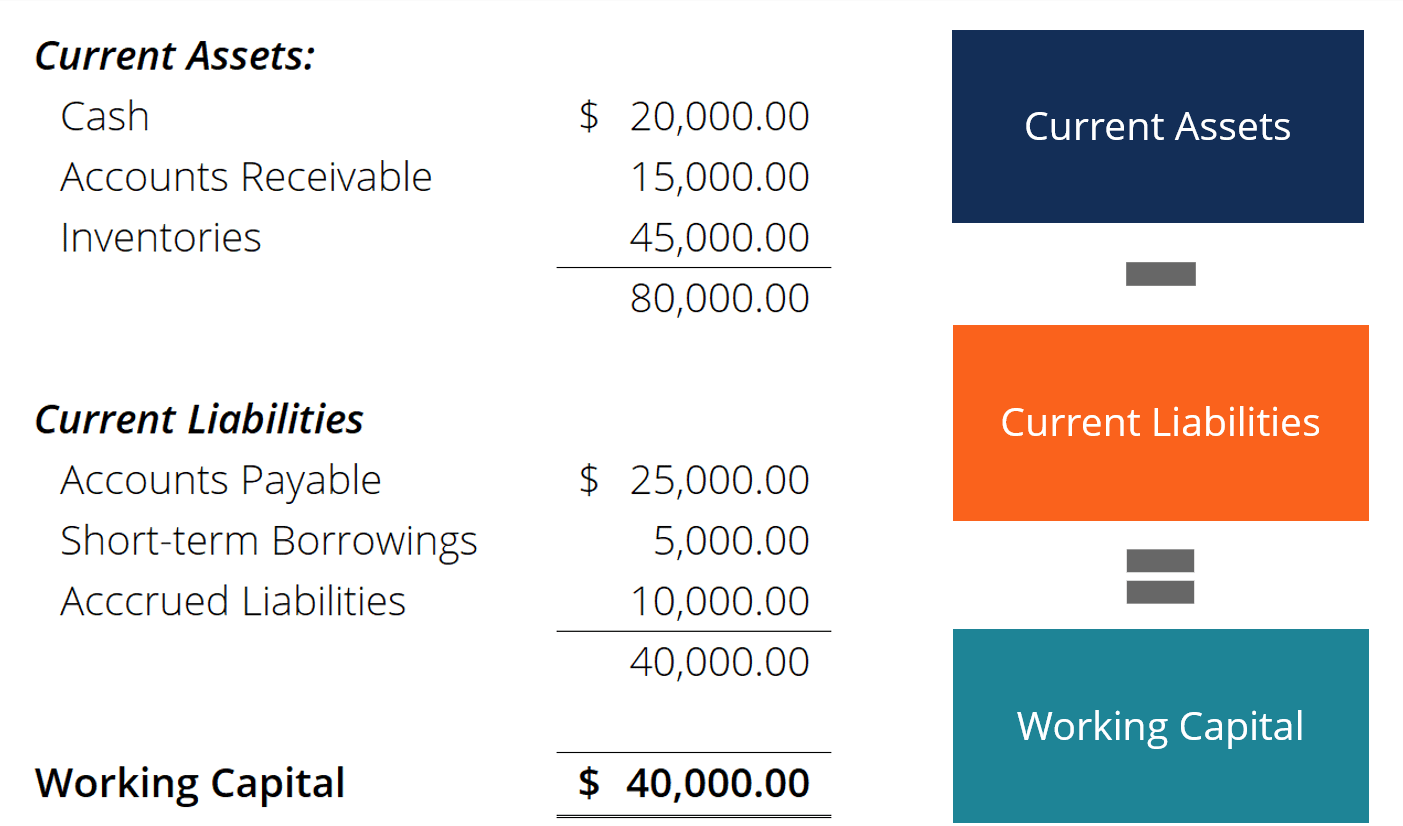

How to calculate the working capital

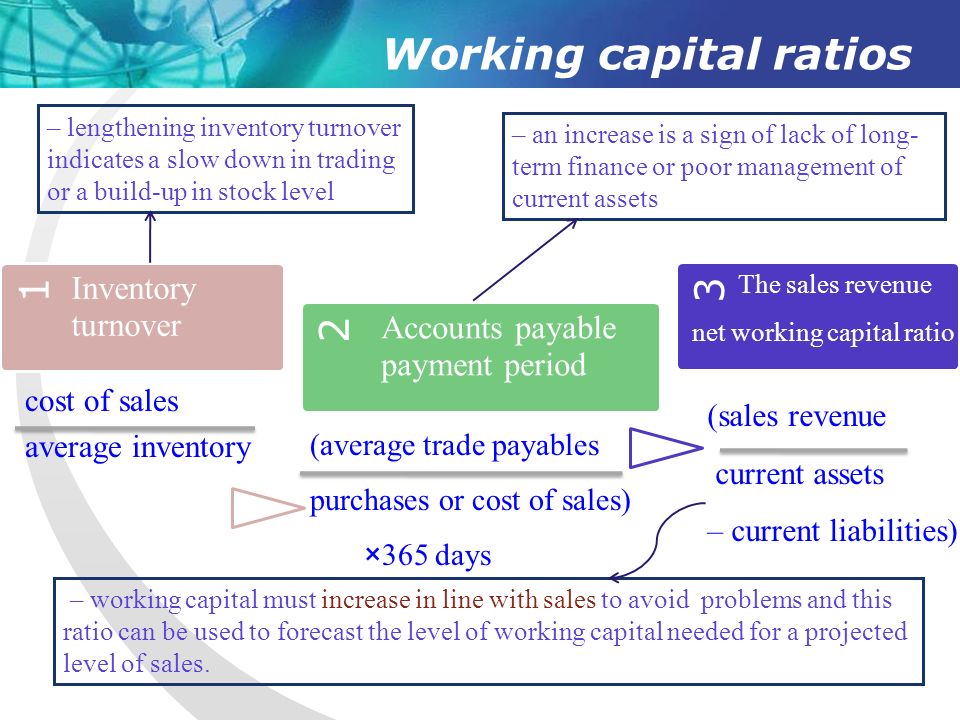

How to calculate the working capital-The basic formula for determining working capital involves only two factors First, it is necessary to define the current liquid assets that the company has This may be somewhat different from general assets, since the focus is on those resources that canWorking Capital Ratios (liquidity) • The "liquidity position" of a business refers to its ability to pay its debts – ie does it have enough cash to pay the bills?

1

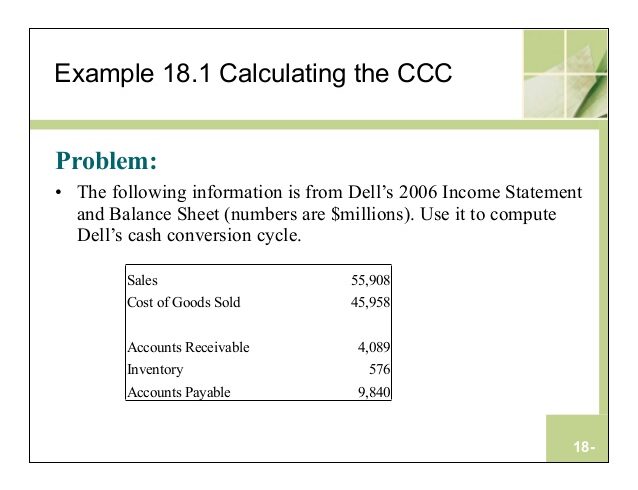

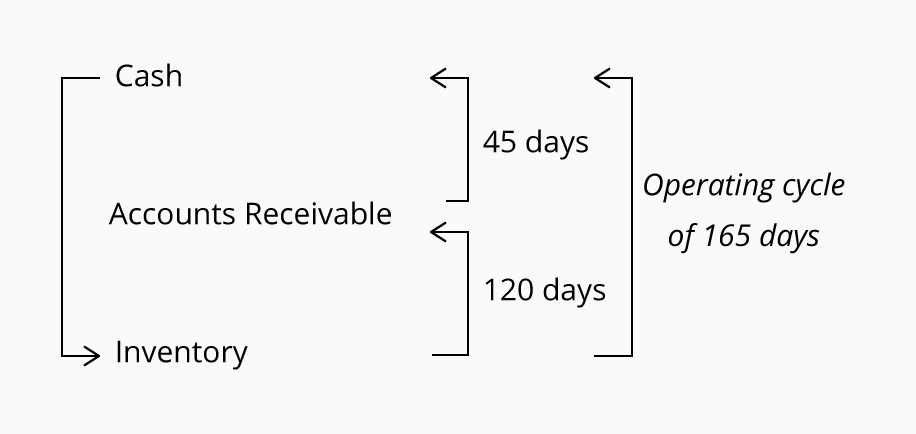

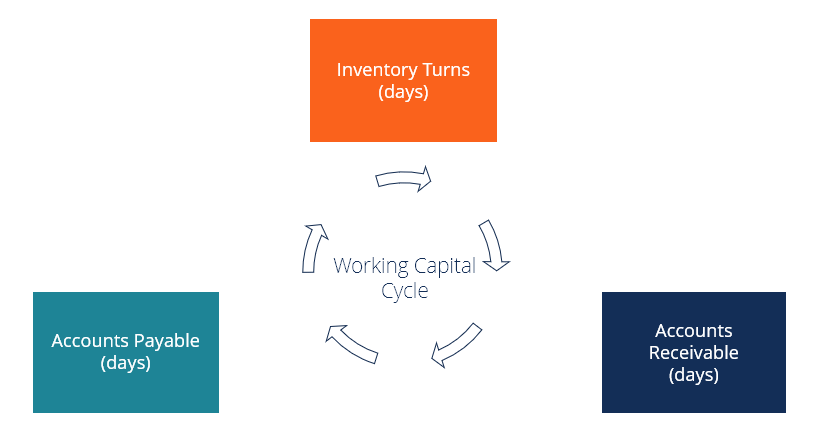

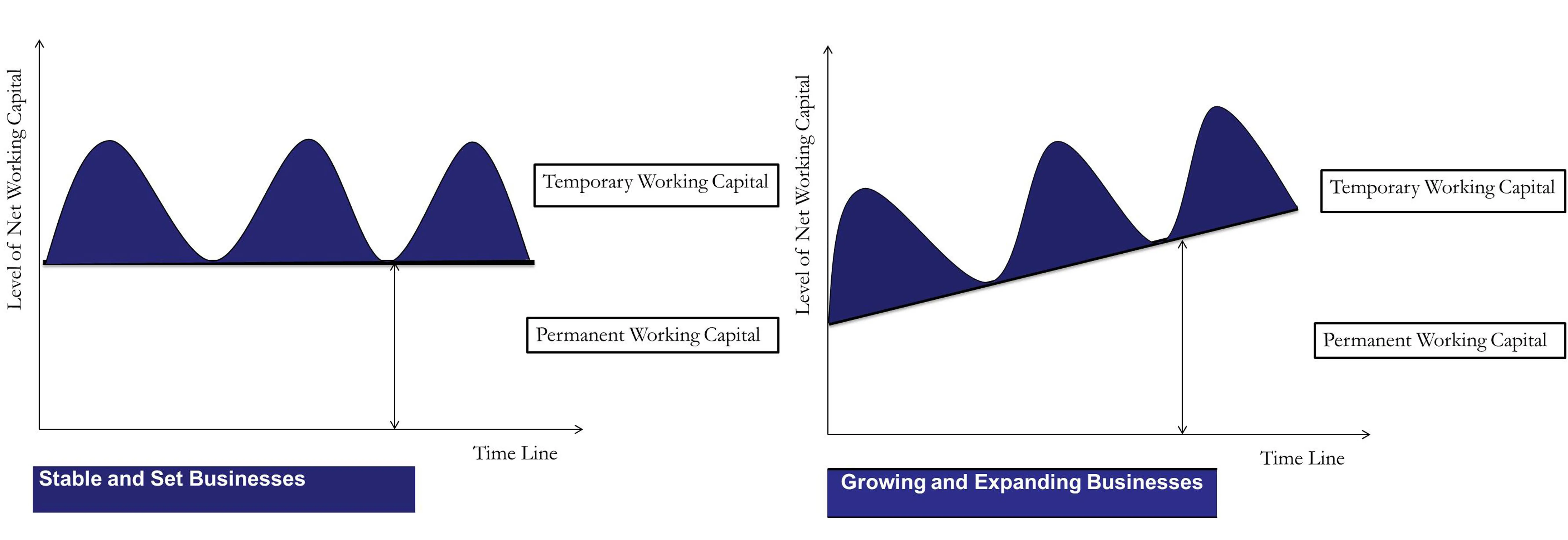

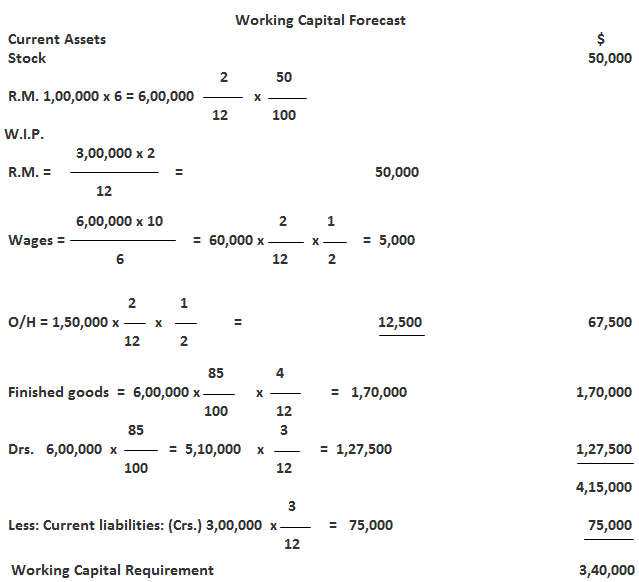

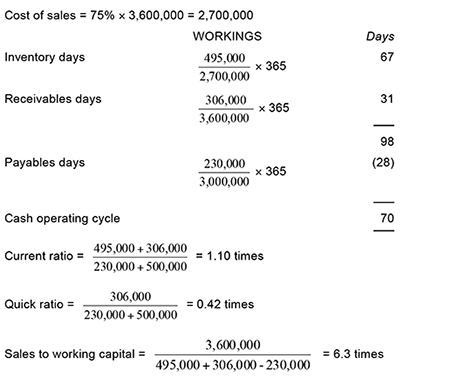

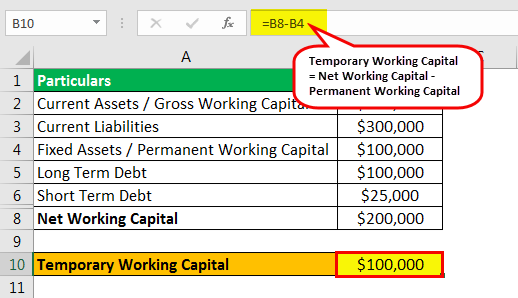

Now that we know the steps in the cycle and the formula, let's calculate an example based on the above information Inventory days = 85 Receivable days = Payable days = 90 Working Capital Cycle = 85 – 90 = 15 This means the company is only out of pocket cash for 15 days before receiving full payment The Usefulness of Working Capital Many entrepreneurs believe that capital is one of the most useful figures that can be extracted from a balance sheet Understanding the meaning of working capital can help your company make important decisions such as How to adjust your level of capital use in response to changes in your business cycle There is no formula for calculating the exact permanent working capital It is an estimation based on the experience of the entrepreneur Statistical data on the balance of all current assets and liabilities can help in deciding that level We can plot the net working capital amount of each day in a table and find the lowest amount in it

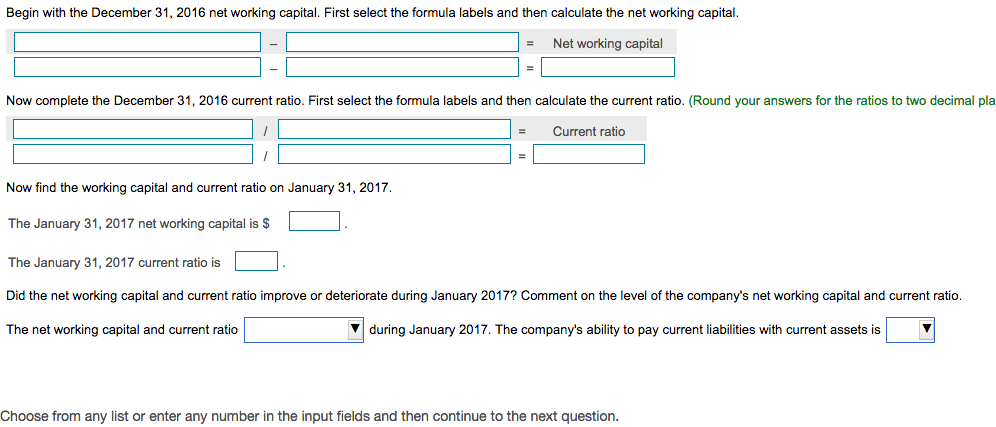

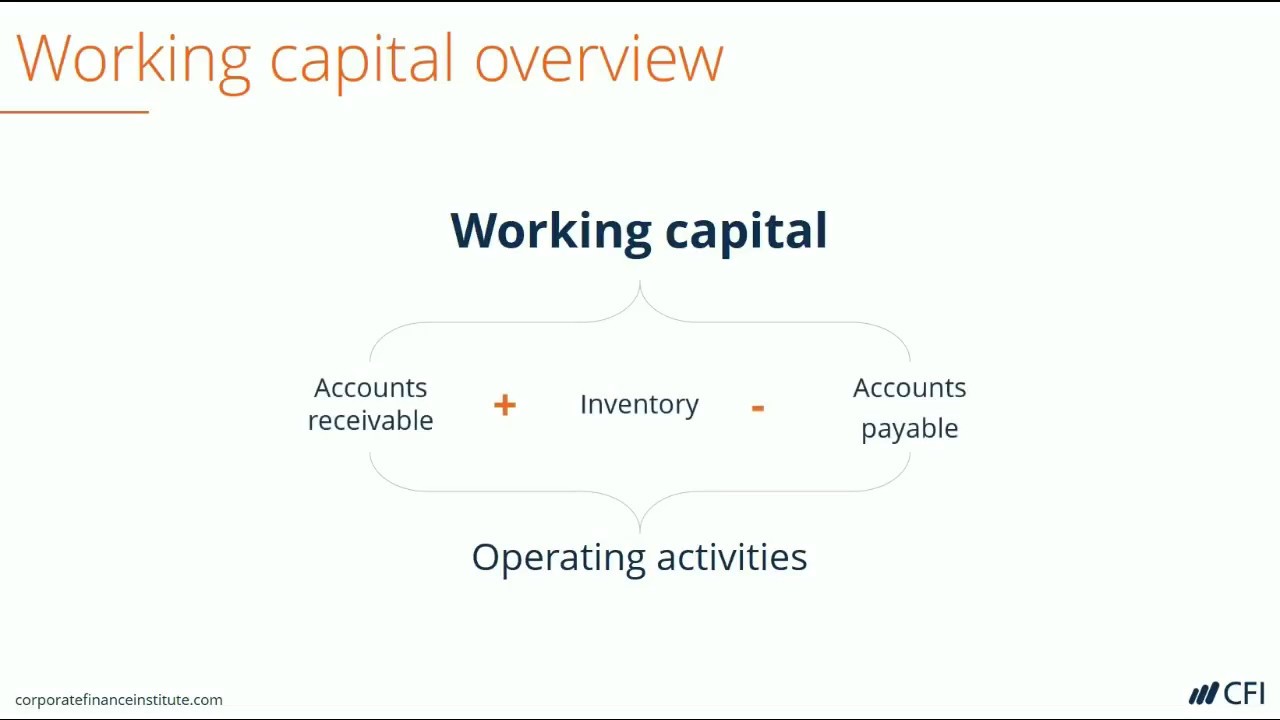

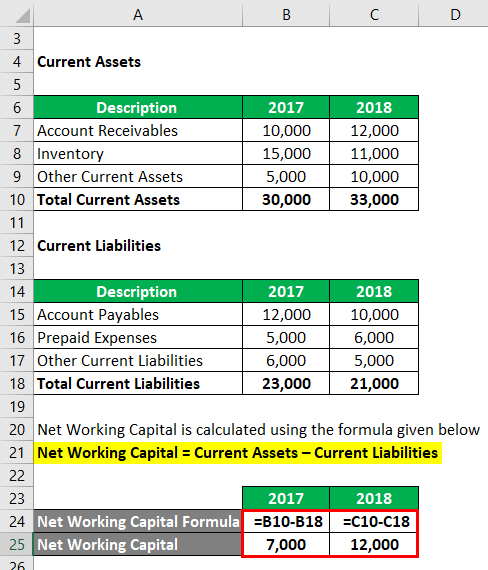

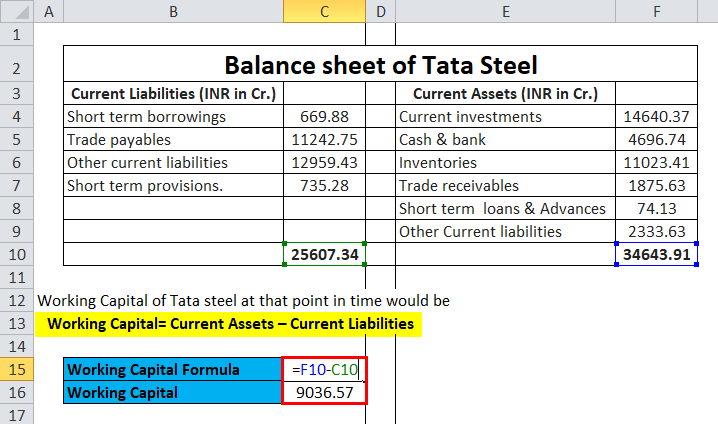

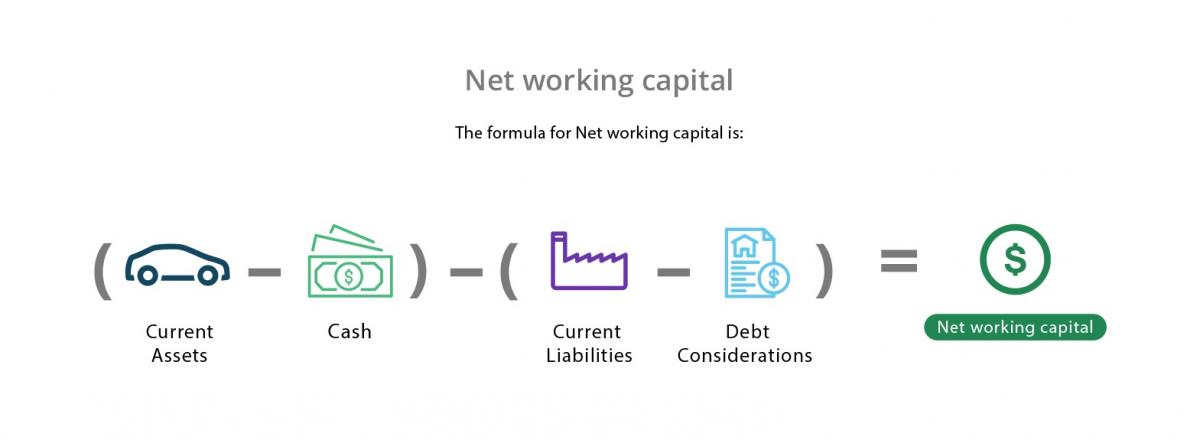

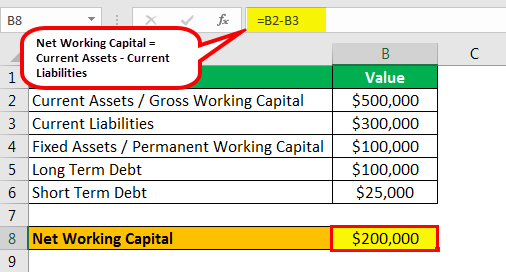

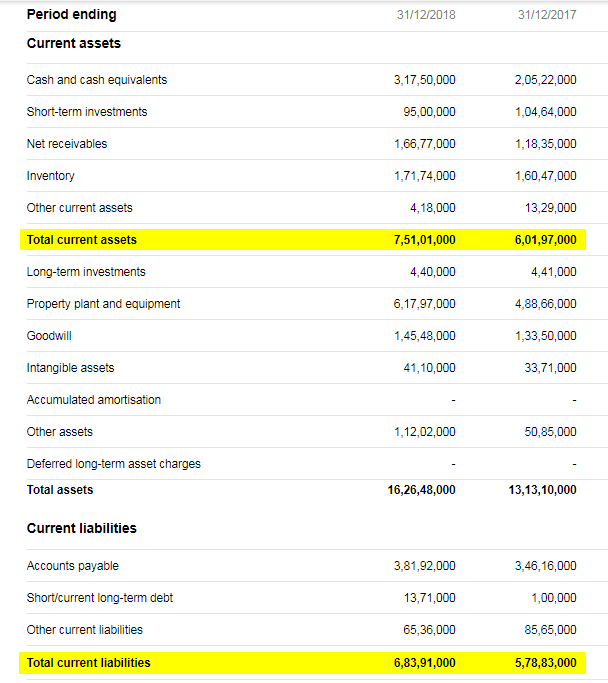

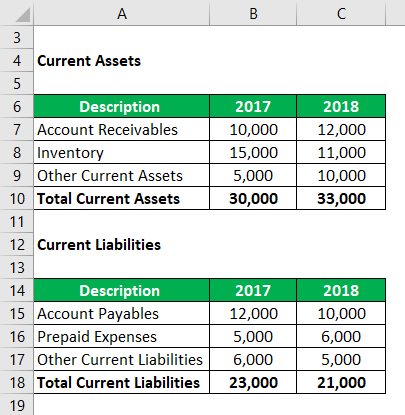

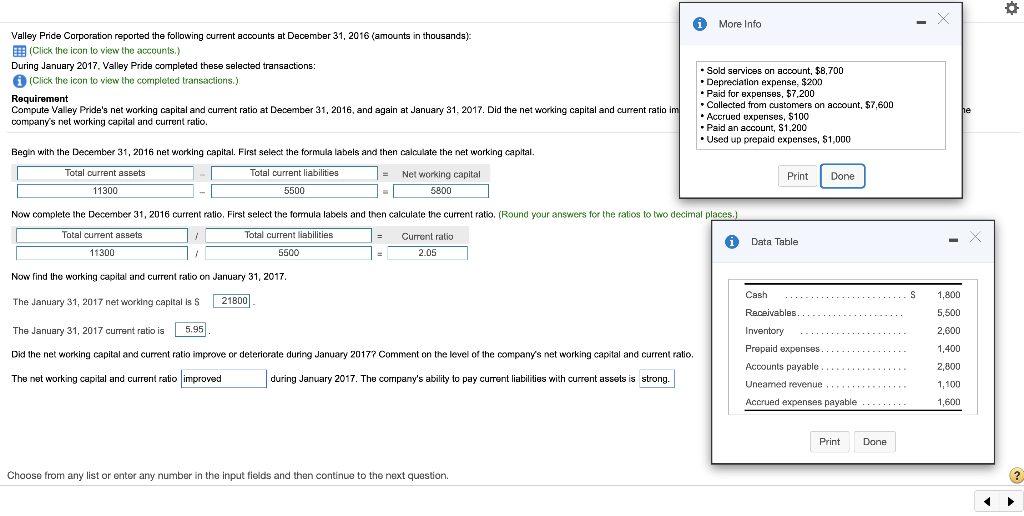

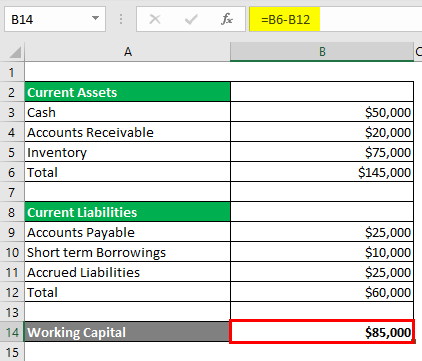

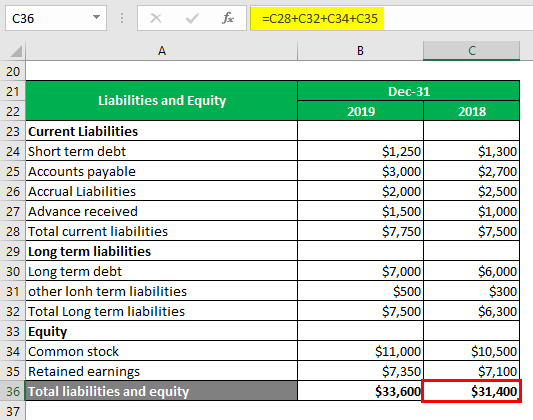

Working capital (WC) is a measure of current assets minus current liabilities on a company's balance sheet When conducting due diligence on a transaction, historical working capital is analyzed on a monthly basis for two to three years in order to understand the appropriate level a business needs to support its operationsNet working capital is a liquidity calculation that measures a company's ability to pay off its current liabilities with current assets This measurement is important to management, vendors, and general creditors because it shows the firm's shortterm liquidity as well as management's ability to use its assets efficientlyInto account in the working capital analysis (for example, deferred revenue or liability reserves) As part of the working capital adjustment, it is necessary to calculate a target working capital This represents the normalised level of working capital of the target business before the closing, on which the parties have agreed It also represents

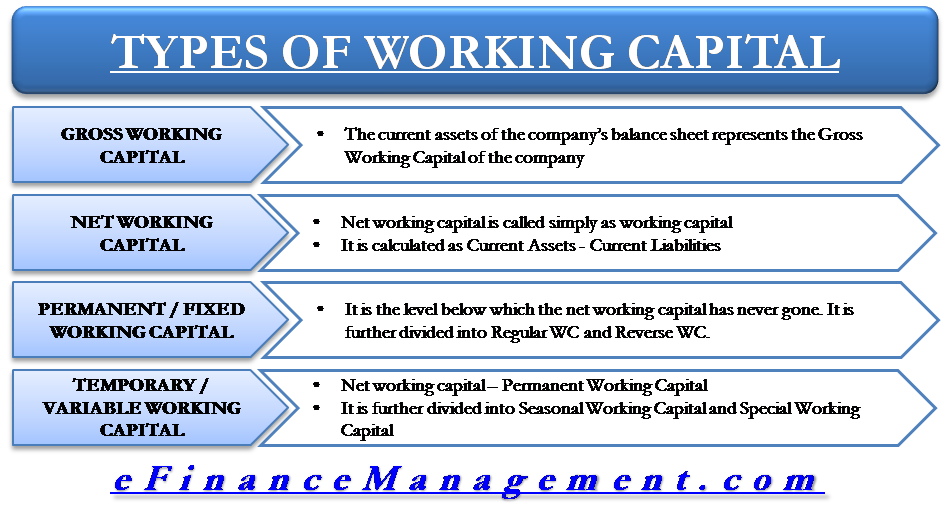

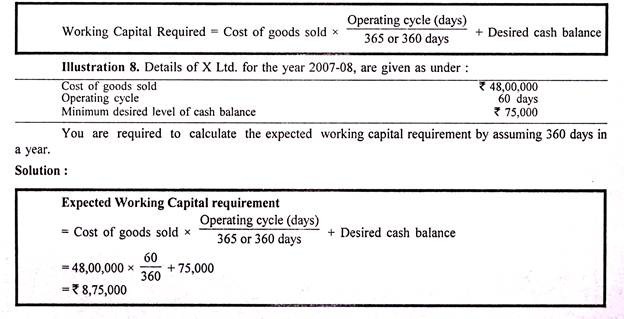

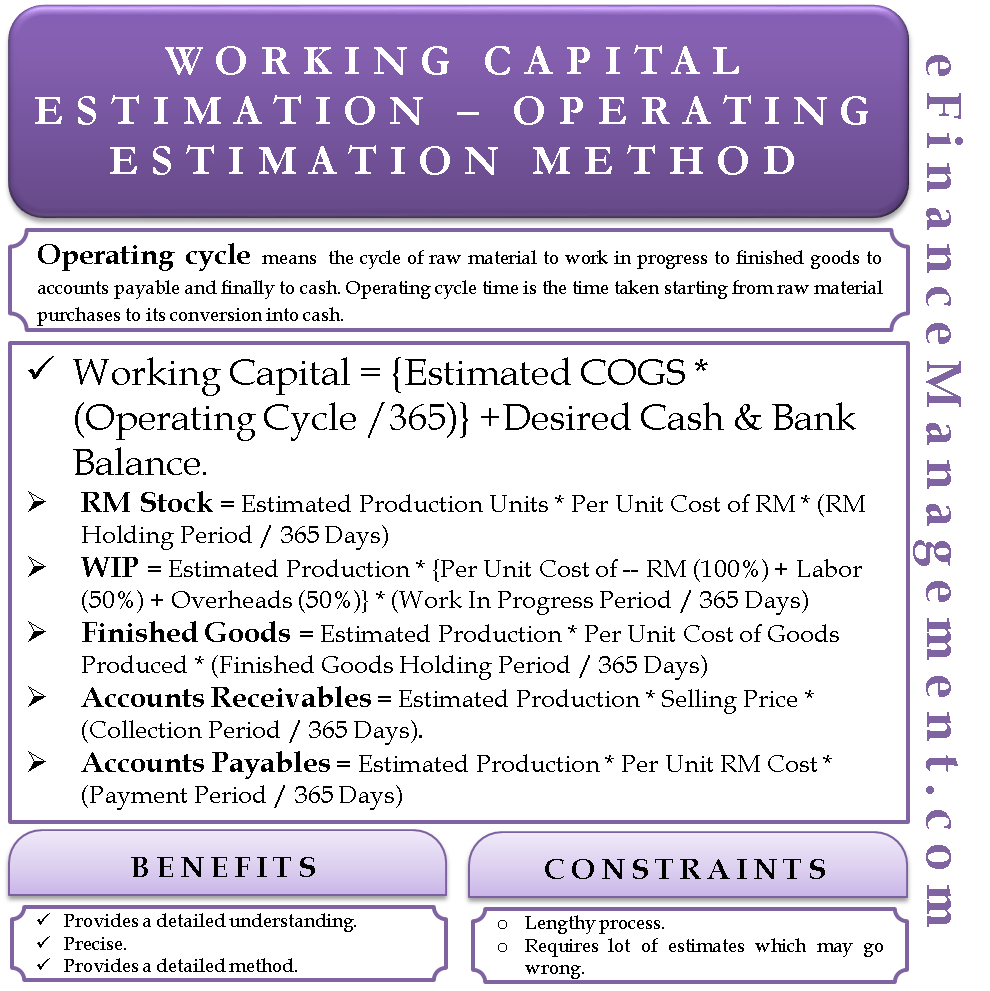

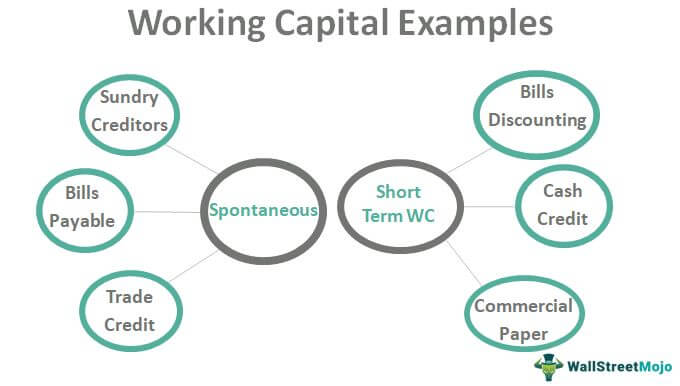

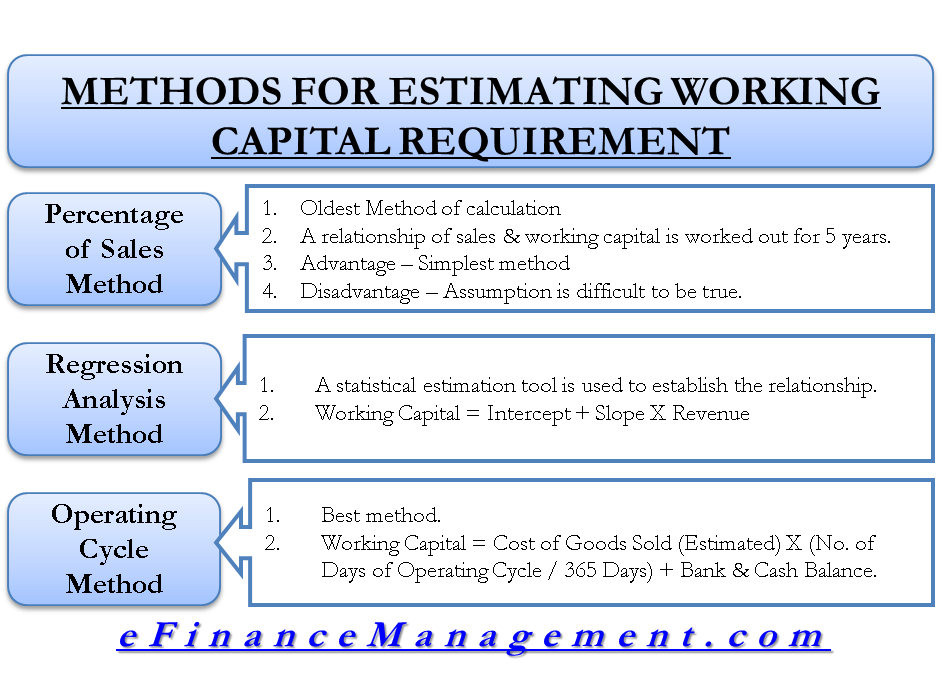

The following points highlight the top three methods of working capital estimation The methods are 1 Percentage of Sales Method 2 Regression Analysis Method 3 Operating Cycle Method 1 Percentage of Sales Method It is a traditional and simple method of determining the level of working capital and its componentsNet Working Capital (NWC) = (working capital gap – shortterm borrowings) The aggregate of current assets is known as Gross Working Capital For example, say the current assets of company XYZ are $10,000,000 and the interest free credit is $2,000,000 andLong term sources of capital used to cover

Net Working Capital Guide Examples And Impact On Cash Flow

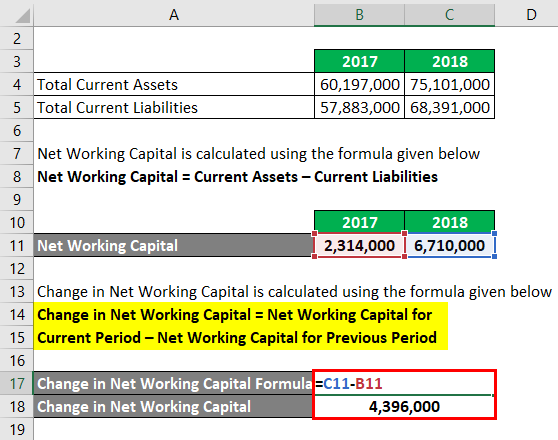

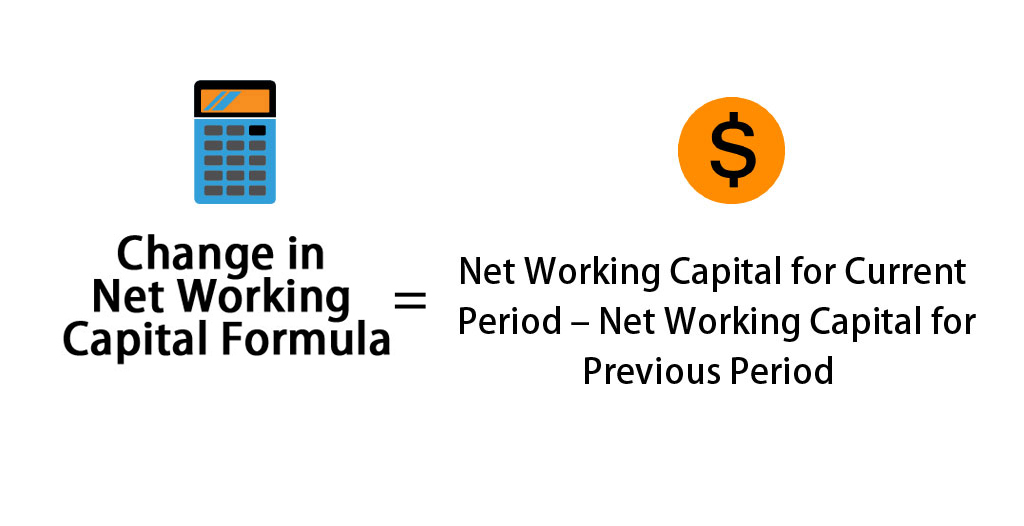

Change In Net Working Capital Formula Calculator Excel Template

The working capital target, a central concept in the working capital calculation, is an estimate typically based on normalized 2 historical averages forWorking capital (abbreviated WC) is a financial metric which represents operating liquidity available to a business, organization, or other entity, including governmental entities Along with fixed assets such as plant and equipment, working capital is considered a part of operating capital Gross working capital is equal to current assets In accounting terms, working capital is equal to current assets minus current liabilities

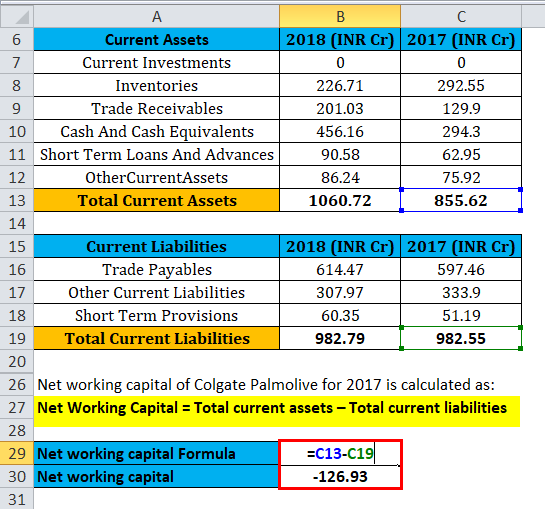

Net Working Capital Formula Calculator Excel Template

1

Permanent / Fixed working capital – the level of working capital below which the business has never gone;What is Net Working Capital?You can get a sense of where you stand right now by determining your working capital ratio, a measurement of your company's shortterm financial health Working capital formula Current assets / Current liabilities = Working capital ratio;

Working Capital Definition Formula Examples With Calculations

1

Determining a Good Working Capital Ratio The ratio is calculated by dividing current assets by current liabilities It is also referred to as the current ratio The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales Working capital is current assets minus current liabilities A high turnover ratio indicates that management is being extremely efficient in using a firm's shortterm assets and liabilities to support sales The formula is How to Interpret Working Capital Under the best circumstances, insufficient working capital levels can lead to financial pressures on a company, which will increase its borrowing and the number of late payments made to creditors and vendors

Capital Employed Definition Formula And Sample Calculation

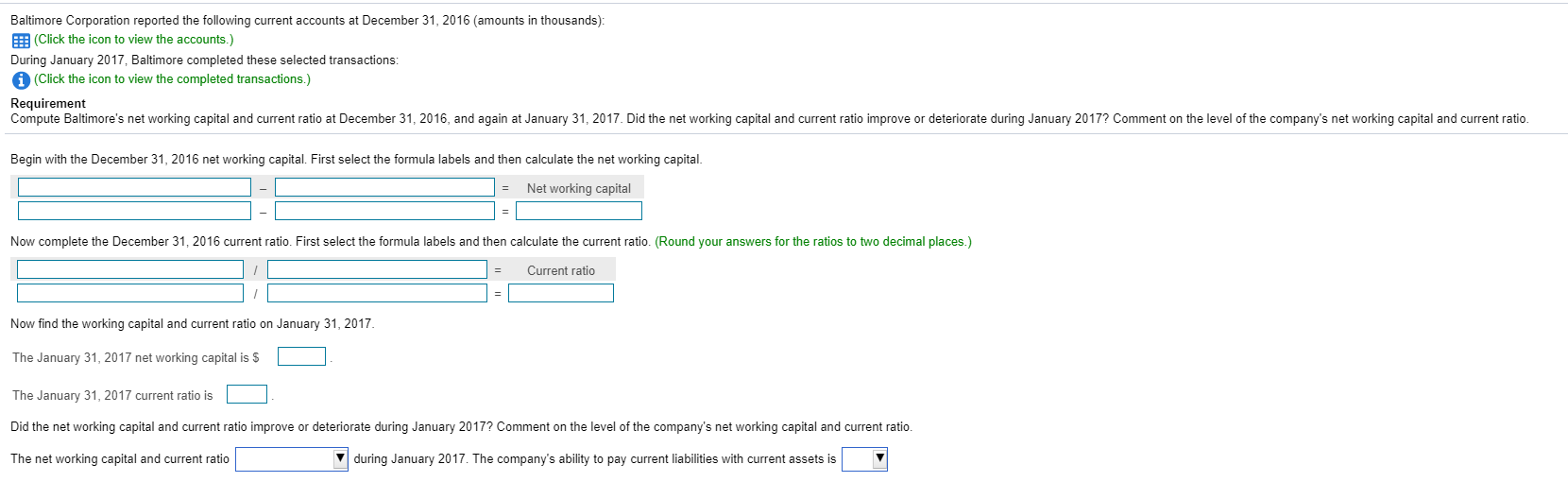

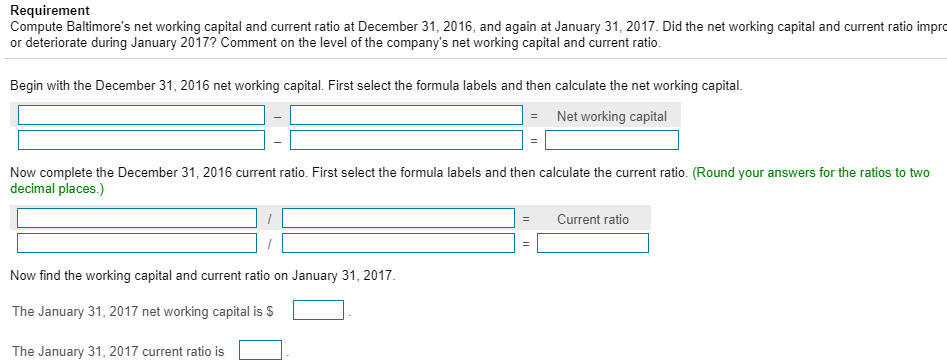

Answered Begin With The December 31 16 Net Bartleby

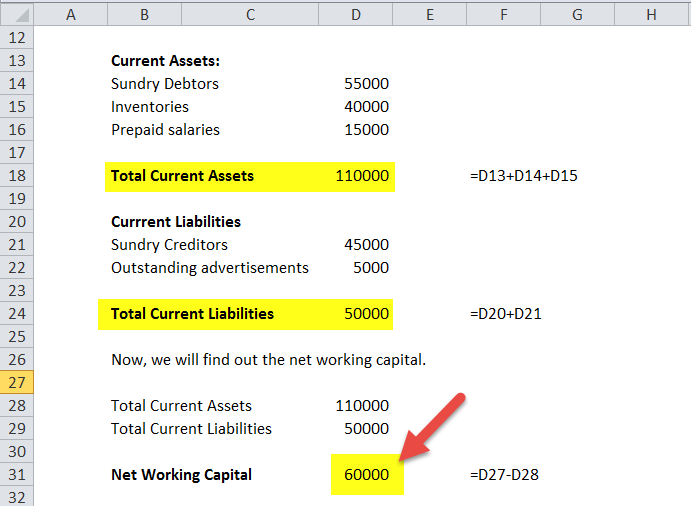

A company with little or no working capital is probably not one with a bright future Calculating working capital is also useful for assessing whether a business is making efficient use of its resources The formula to calculate working capital is Working capital = current assets current liabilities Steps The working capital target, a central concept in the working capital calculation, is an estimate typically based on normalized historical averages for the date of closing After closing (usually within a specified period, eg 60 or 90 days), the purchaser must produce a finalized calculation of the actual working capital on the closing dateTo calculate a company's average working capital, the following formula is used (Working capital of the current year Working capital of the prior year) ÷ 2 This indicates whether a company possesses enough shortterm assets to cover shortterm debt Understanding the Working Capital Ratio

Working Capital Example Formula Definition Wall Street Prep

Change In Working Capital Video Tutorial W Excel Download

Using the working capital formula and the information above, we can calculate that XYZ Company's working capital is $160,000 $65,000 = $95,000 Remember, the balance sheet is a snapshot of where things stand on the last day of the accounting period, so we need to multiply this $95,000 by 365 days What does cash conversion cycle imply? Negative working capital is closely tied to the current ratio, which is calculated as a company's current assets divided by its current liabilities If a current ratio

Management Of Working Capital

:max_bytes(150000):strip_icc()/workingcapital-7044a3fc24ff4cb48cddab89700ee12d.jpg)

What Is Working Capital

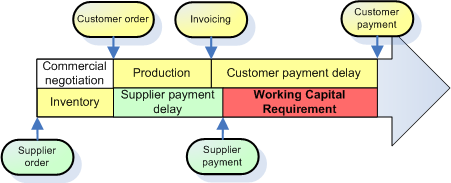

Net working capital is an important component to any transaction Gaining a comprehensive understanding of net working capital provides buyers the level of cash required to operate the business post transaction close, thereby avoiding unanticipated additional cash infusionCash conversion cycle, also known as net operating cycle or working capital cycle, indicates the length of time between a company's payment for raw materials, entry into stock, storage into the warehouse, and receipt of cash from the ultimate sales of finished goodsIn simple terms, a cash conversion cycle is a measure ofInventory to working capital is a liquidity ratio that measures the amount of working capital that is tied up in inventory The difference between total current assets and total current liabilities is known as working capital or net working capitalWorking capital

Working Capital Example Formula Definition Wall Street Prep

Working Capital Meaning Ratio Example Formula Cycle

Weighting of other purshases 1 x 1,196 / 8 = 0,15 The normative Working Capital Requirement represents 55,3 days of sales, which mean a value of 1212 K€ (55,3 / 365 x 8 M€) My DSO Manager, the innovative credit management softwareThe Inventory to Working Capital ratio measures how well a company is able to generate cash using Working Capital at its current inventory level Importance of Inventory to Working Capital An increasing Inventory to Working Capital ratio is generally a negative sign, showing the company may be having operational problemsIn nearly every transaction, a buyer will require a selling company to leave behind a defined minimum amount of working capital A company uses working capital (current assets minus current liabilities) to fund its ongoing operations

Change In Net Working Capital Formula Calculator Excel Template

Net Working Capital Formulas Examples And How To Improve It

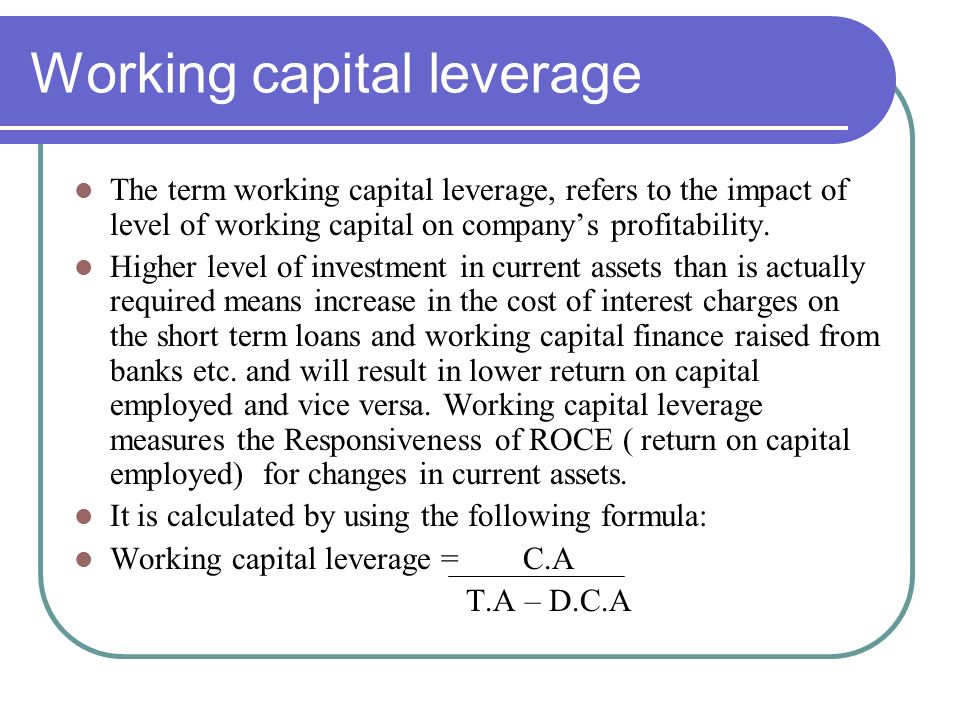

Estimating Working Capital Requirement Method # 2 Regression Analysis Method (Average Relationship between Sales and Working Capital) This method of forecasting working capital requirements is based upon the statistical technique of estimating or predicting the unknown value of a dependent variable from the known value of an independent variable Working capital is a snapshot of a present situation, while cash flow measures the ability to generate cash over a specific period Most businesses with high cash flow will also have high working capital But there can be some divergence depending on things like investments, paying off old debt and paying dividends to shareholders Excess working capital carries the 'carrying cost' or 'interest cost' on the capital lying unutilized Shortage of working capital carries 'shortage cost' which include disturbance in production plan, loss in revenue etc Finding the optimum level of working capital is the main goal or winning situation for any business manager

Working Capital Formula How To Calculate Working Capital

Baltimore Corporation Reported The Following Current Chegg Com

The Basic Formula It has been said that the lifeblood of any business is its net working capital (WC) The simplest explanation of this figure is the formula WC = Current assets – Current liabilities In other words, it is the amount of assets available to pay off your short term expenses such as salaries, equipment rental, inventory, andThe working capital formula is Working Capital = Current Assets – Current Liabilities The working capital formula tells us the shortterm liquid assets available after shortterm liabilities have been paid off It is a measure of a company's shortterm liquidity and is important for performing financial analysis, financial modelingIf you have current assets of $1 million and current liabilities of $500,000, your working capital ratio

Changes In Working Capital Fcf And Owner Earnings

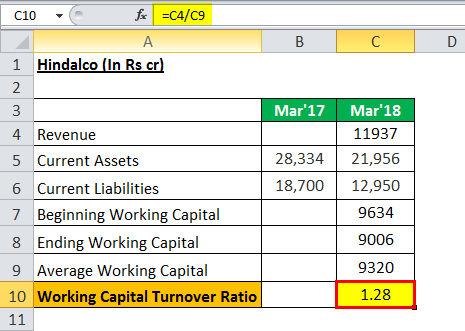

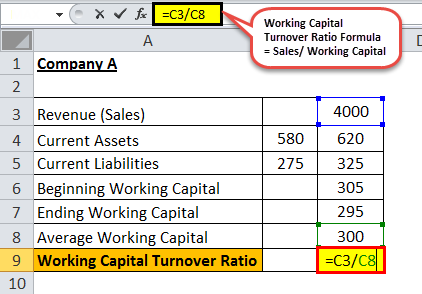

Working Capital Turnover Ratio Meaning Formula Calculation

Working capital can only be adjusted downward (which favors the seller), not upward (which would favor buyers) Working capital is only adjusted if, at closing, it is above or below the target working capital by a set amount, for example, $250,000• The balance sheet of a business provides a "snapshot" of the working capital position at a particular point in timeIn this ratio working capital is defined as the level of investment in inventory and receivables less payables In exam questions you may have to assume that yearend working capital is representative of the average figure over the year The sales to working capital ratio indicates how efficiently working capital is being used to generate sales

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)

What Is Working Capital

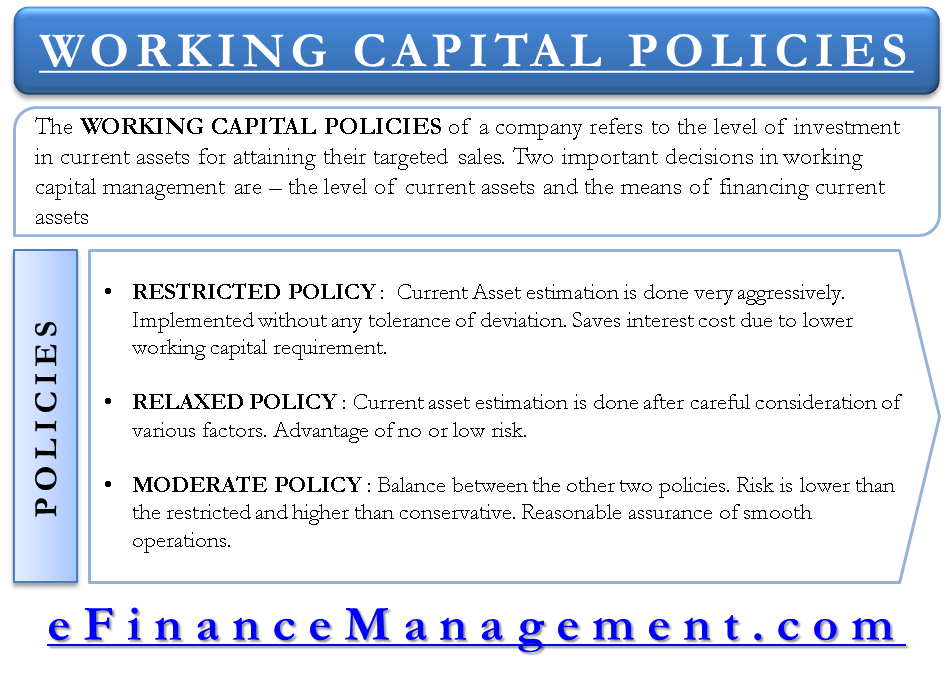

Working Capital Policy Relaxed Restricted And Moderate

Formula Working Capital Ratio = Current Assets ÷ Current Liabilities Generally speaking, it can be interpreted as follows If this ratio around 12 to 18 – This is generally said to be a balanced ratio, and it is assumed that the company is a healthy state to pay its liabilities If it is less than 1 – It is known as a negative working capital, which generally means that the company is unable to payAnother working capital measurement, the current ratio, divides the shortterm assets total by the shortterm liabilities total In general, the target value for the current ratio equals or exceedsThat is, the ability to meet obligations when due At a high level, the calculation of working capital is as follows Current assets Current liabilities = Working capital

Change In Net Working Capital Formula Calculator Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

Working capital is usually defined as net current assets (excluding cash) adjusted for any debtlike items such as unpaid corporation tax, loans and hire purchase liabilities There is no standard formula for how to calculate the NWC and every transaction is unique in this regard, but any calculation must have regard to both timing and contentSuch investments are able to be sold at any time to cover the emerging need for working capital Formula Longterm financing = Noncurrent Assets Permanent Working Capital Part of Temporary Working Capital Shortterm financing = Part of Temporary Working Capital Advantages and disadvantagesWorking capital = current assets less current liabilities Working capital provides a strong indication of a business' ability to pay is debts Every business needs to be able to maintain daytoday cash flow It needs enough to pay staff wages when they fall due, and to pay suppliers when invoice payment terms are reached

How To Calculate Working Capital With Calculator Wikihow

How To Calculate Working Capital Requirement Plan Projections

The level of working capital affects the degree of risk and profitability both Hence the level of working capital should be so fixed that, on the one hand, its financial soundness is maintained and on the other hand, its profitability is optimizedOverall working capital policy considers both a firm's level of working capital investment and its financingIn practice, the firm has to determine the joint impact of these two decisions upon its profitability and riskHowever, to permit a better understanding of working capital policy, the working capital investment decision is discussed in this section, and the working capital Working capital is calculated by subtracting current liabilities from current assetsIt is used in several ratios to estimate the overall liquidity of a business;

Learn Everything About Working Capital Formula Bestbussinesscircle

Working Capital And Liquidity Explanation Accountingcoach

Working Capital Cycle

Change In Net Working Capital Formula Calculator Excel Template

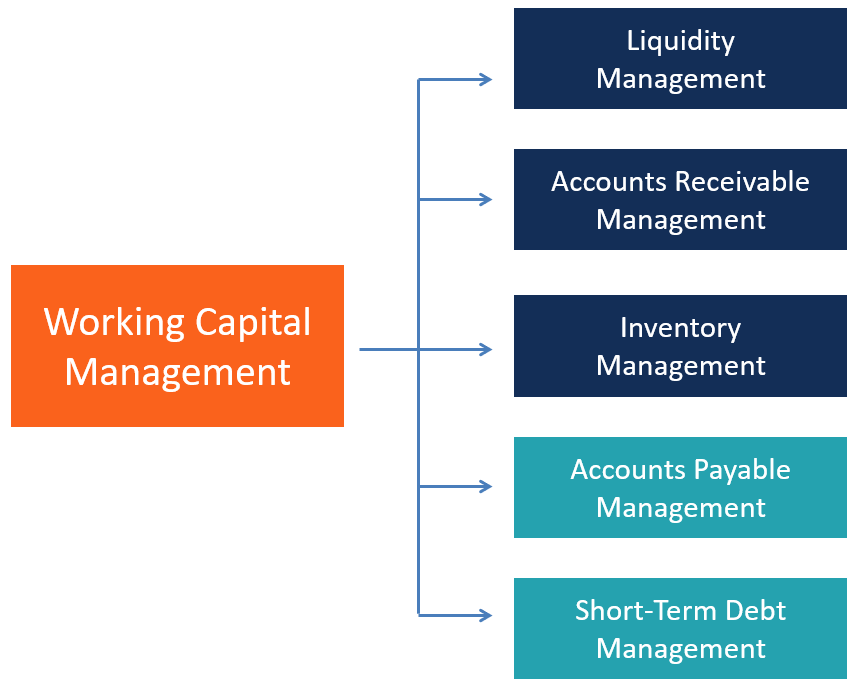

Working Capital Management Overview How It Works Importance

Types Of Working Capital Gross Net Temporary Permanent Efm

Working Capital Formula How To Calculate Working Capital

Working Capital Management Acca Global

Working Capital Example Formula Definition Wall Street Prep

Working Capital Ratio Analysis Example Of Working Capital Ratio

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital What Is It And Why It S Important

Treasury Essentials The Cash Conversion Cycle The Association Of Corporate Treasurers

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Formula Calculator Excel Template

Working Capital Cycle Understanding The Working Capital Cycle

Assessment And Computation Of Working Capital Requirement

Working Capital Calculation Double Entry Bookkeeping

/looking-mor-money-959324602-fa756e8a1de8445e9edd469b30c1bb33.jpg)

Working Capital Management Definition

The Working Capital

:max_bytes(150000):strip_icc()/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)

What Changes In Working Capital Impact Cash Flow

How To Calculate Working Capital The Working Capital Formula

Baltimore Corporation Reported The Following Current Chegg Com

Working Capital Example Formula Definition Wall Street Prep

Working Capital The Definition Formula

How To Calculate Working Capital With Calculator Wikihow

Permanent Or Fixed Working Capital

Working Capital Management Module 1 Introduction Working Capital Or Short Term Finance Refers To Current Assets And Current Liabilities There Are Two Ppt Download

How To Calculate Working Capital Requirement Plan Projections

Change In Working Capital Video Tutorial W Excel Download

Working Capital Example Meaning Investinganswers

Net Working Capital Formula Example Calculation Ratio Envestopedia

Working Capital Estimation Operating Cycle Method

Working Capital Financial Edge

:max_bytes(150000):strip_icc()/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)

Working Capital Nwc Definition Formula Examples

Chapter 4 Working Capital Ppt Download

Working Capital Calculation Your How To Guide Fast Capital 360

How To Calculate Working Capital With Calculator Wikihow

Working Capital Example Formula Definition Wall Street Prep

Adjusted Working Capital Definition Formula Example

Cfa Level I Working Capital Management Part I Youtube

How To Calculate Working Capital The Working Capital Formula

What Is Working Capital Meaning Definition Formula Management Net Working Capital And Example

Estimating Working Capital Requirements Solved Problems Finance Strategists

Working Capital Requirements In A Manufacturing Business Plan Projections

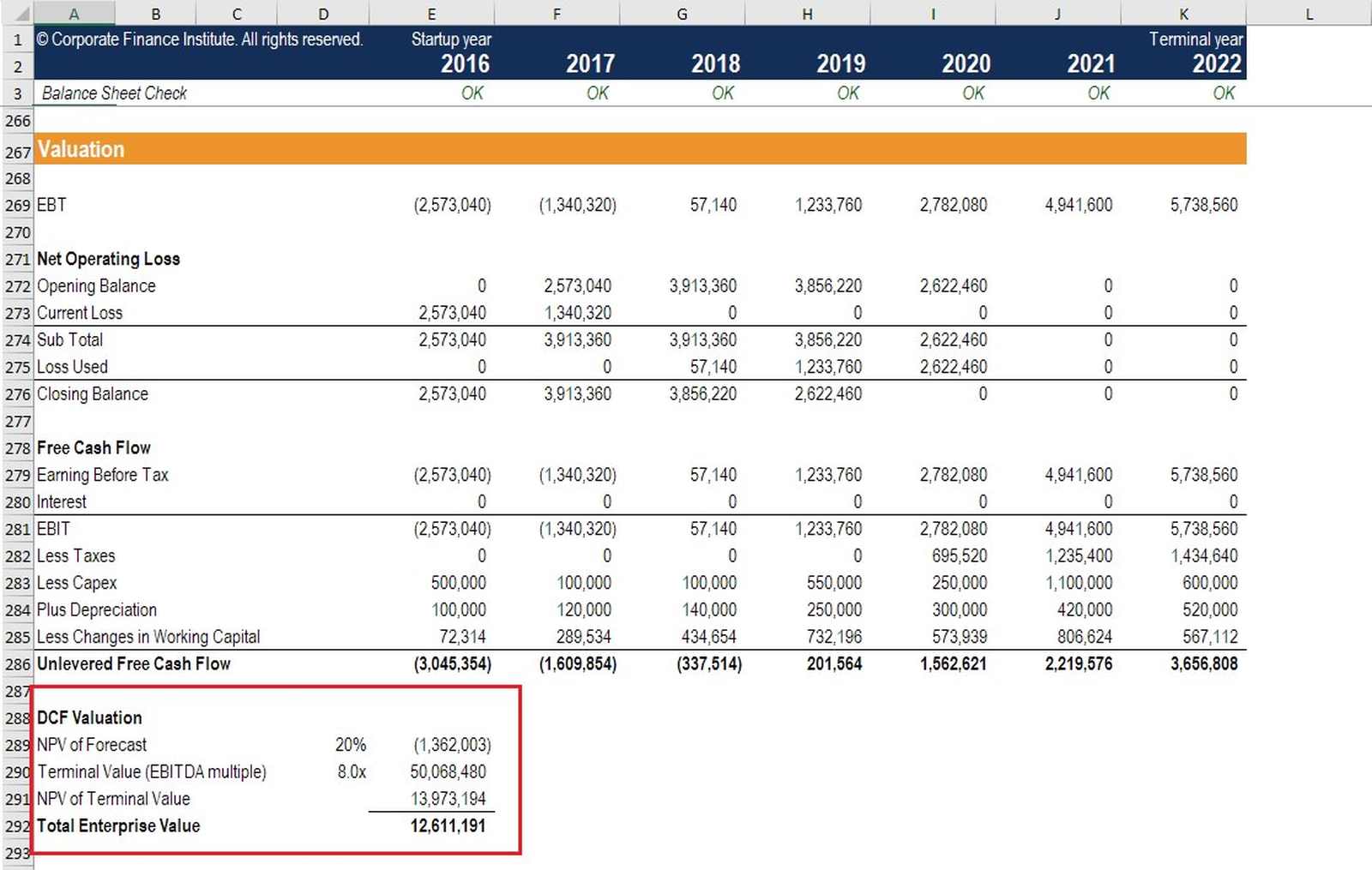

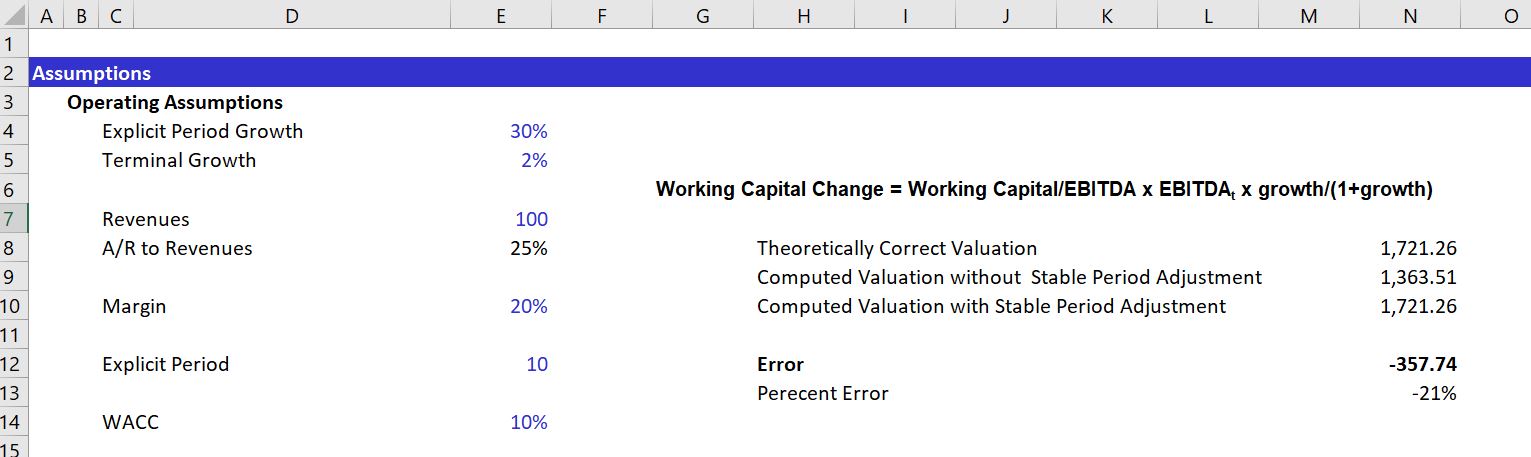

Working Capital In Valuation

Net Working Capital Formulas Examples And How To Improve It

Working Capital Examples Top 4 Examples With Analysis

17 Level I Cfa Corporate Finance Working Capital Summary Youtube

Change In Net Working Capital Formula Calculator Excel Template

Net Working Capital Guide Examples And Impact On Cash Flow

Net Working Capital Definition Formula How To Calculate

Change In Working Capital Video Tutorial W Excel Download

1

Working Capital Examples Top 4 Examples With Analysis

Working Capital Management Acca Global

Change In Net Working Capital Formula Calculator Excel Template

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)

What Is Working Capital

Levels Of Working Capital Investment In Financial Management Tutorial 29 July 21 Learn Levels Of Working Capital Investment In Financial Management Tutorial 6667 Wisdom Jobs India

Working Capital Formula How To Calculate Working Capital With Example Youtube

Methods For Estimating Working Capital Requirement

Cfa Level 1 Working Capital Management Part 1 Mp4 Youtube

Working Capital What It Is And How To Calculate It Efficy

Working Capital What It Is And How To Calculate It Efficy

Change In Working Capital Meaning And Full Tutorial Calculations Excel

More Info Valley Pride Corporation Reported The Chegg Com

3

What Is The Working Capital Formula Revenued

Working Capital Example Top 4 Examples Of Working Capital

Changes In Net Working Capital Step By Step Calculation

Working Capital Examples Top 4 Examples With Analysis

Working Capital Formula How To Calculate Working Capital

What Is Net Working Capital How To Calculator Nwc Formula

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Working Capital Formula Calculator Excel Template

Working Capital Example Top 4 Examples Of Working Capital

How To Calculate Working Capital With Calculator Wikihow

Working Capital Formulas And Why You Should Know Them Fundbox

0 件のコメント:

コメントを投稿